wikifoliossuch as the All-in-One strategy are among the most exciting ways in which investors and traders can implement their investment ideas today. In this article, you will learn what wikifolio is, what advantages it offers for investors and traders, how the performance fee works and why the All-in-One strategy is worth a closer look. With practical examples and a detailed insight into a real portfolio, you will get all the information you need to make informed decisions.

What is wikifolio?

wikifolio is an online platform that enables traders to publish their trading strategies as so-called model portfolios – the “wikifolios”. Investors can invest in these strategies on the stock exchange via certificates issued by Lang & Schwarz Aktiengesellschaft. The platform was founded in 2012 and has become a popular place where both private investors and professional traders come together.

Structure and mechanics

Each wikifolio is a virtual model portfolio that can be viewed publicly. Traders actively manage this portfolio and make buy and sell decisions. The issuer Lang & Schwarz replicates it in the form of a tradable certificate. Investors acquire this certificate via their bank or broker and thus participate in the performance.

Advantages for investors?

- Transparency: Investors can view the composition, transactions and performance at any time.

- Access to expert knowledge: Strategies from experienced traders are easily accessible.

- Variety: From conservative dividend strategies to speculative trading approaches, everything is represented.

- Flexibility: You can join and leave the program at any time.

- Cost efficiency: No traditional management fees, but performance fees only on profits.

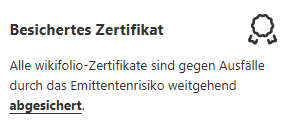

Security & regulation

wikifolio works together with Lang & Schwarz Aktiengesellschaft, which is subject to supervision by BaFin. The wikifolio certificates issued are bearer bonds, but are structured as collateralized certificates. This means that they are backed by collateral assets that are held separately from the issuer’s assets. Exactly how these collateral assets are structured is at the discretion of Lang & Schwarz – including the type of assets used as collateral. This collateralization significantly reduces the issuer risk for investors, but investors should nevertheless be aware that there is a residual risk.

Examples of successful investor strategies

Successful investor strategies on wikifolio are very diverse. These include dividend strategies, which generate a constant cash flow through regular distributions and are particularly attractive for income-oriented investors. Momentum strategies, on the other hand, make targeted use of short-term market opportunities by focusing on securities that are in an upward trend. Value investing strategies, which identify undervalued stocks with long-term potential, are also popular, as are commodity strategies, which invest in precious metals or energy sources in order to benefit from price increases. Global multi-asset strategies combine different asset classes in order to reduce fluctuations through broad diversification. Technology and future trends strategies are also in high demand, as they focus on innovative sectors such as artificial intelligence or renewable energies.

Advantages for traders?

- Monetization of your own strategy: Traders can earn real money with their trading ideas by receiving performance fees as soon as their wikifolio reaches new highs. Traders set the amount of this performance fee when creating the wikifolio – between 5% and 30%.

- Reach and brand building: Through public visibility on wikifolio, traders can build their reputation and gain a loyal community of investors.

- Feedback and community exchange: The platform enables interactions with investors who can provide valuable feedback and thus contribute to improving the strategy.

- No broker ties – freely selectable securities from a large universe: Traders are not tied to a specific broker and can choose from a wide selection of shares, ETFs, funds and other financial instruments.

Performance fee in detail

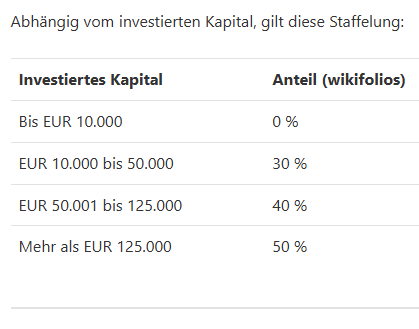

The performance fee is always applied when a new high watermark (annual high) is reached in the wikifolio. It applies to the difference between the old and the new high. Based on this performance fee, traders receive a performance fee – a percentage of the performance fee, graduated according to the capital invested in the associated wikifolio certificate.

Staggered performance bonus for traders

Example: A wikifolio certificate has an invested capital of EUR 60,000 at the start of the year. The trader has set a performance fee of 20%. With an annual performance of 18%, this corresponds to an increase in value of EUR 10,800. The performance fee of 20% (= EUR 2,160) is calculated from this amount. After deducting VAT (19% in the example), EUR 1,815.12 remains as the basis for calculation. As the invested capital is over EUR 50,000, the performance fee is 40%. The trader therefore receives EUR 726.05 as a performance fee. If applicable, value added tax must be taken into account.

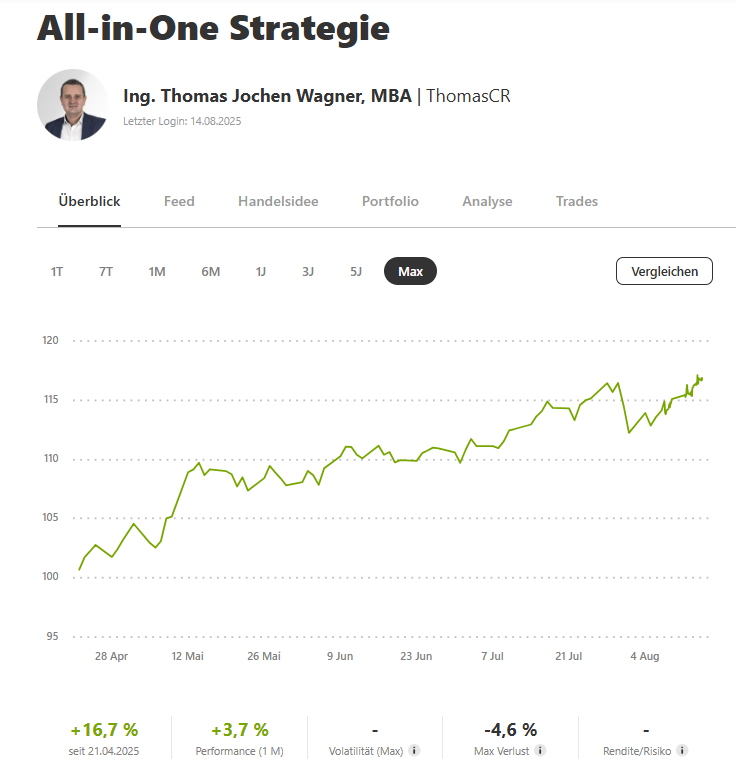

Presentation of the All-in-One strategy

The all-in-one strategy combines various asset classes to create a balanced portfolio. The aim is to achieve stable long-term returns and broadly diversify risks. Click here for the portfolio.

Asset classes in the all-in-one strategy

- Equities: Core of the portfolio to benefit from long-term economic growth.

- ETFs: For cost-effective diversification.

- Commodities: protection against inflation and crises.

- Cryptocurrencies via ETPs: Use of exchange-traded products (ETPs) to participate in the performance of leading cryptocurrencies such as Bitcoin, Ethereum or Solana without holding them directly. This enables diversification in the digital asset sector while at the same time being tradable via regulated exchanges.

- Liquidity in CHF: Part of the portfolio is held in Swiss francs to create currency diversification, increase stability in volatile market phases and potentially benefit from a safe haven in times of crisis.

Example trade from the All-in-One strategy

Initial situation: Market uncertainty due to geopolitical tensions. Decision: Increase gold allocation to reduce risk. Additional increase in cryptocurrency ETPs in anticipation of a bull market due to impending interest rate cuts and expansionary monetary policy. Result: Stabilization of overall performance during a market downturn while participating in possible upward movements in the crypto market.

This is how you invest!

- Open a broker or bank account – we recommend Flatex as an affordable and reliable online broker. Open an account with Flatex here

- Select your desired wikifolio, e.g. the All-in-One strategy: View directly here

- Buy a certificate on the stock exchange using the ISIN.

- Monitor developments and adjust if necessary.

Selection tips

- Check performance history: Pay attention to how the wikifolio has performed in different market phases and whether the results are consistent.

- Understanding key risk figures: Key figures such as volatility or maximum drawdown help to estimate how strong the fluctuations in value can be.

- Transparency of trades and strategy analysis: All trades are publicly visible, including times, prices and price development of the positions, which enables a detailed analysis of the strategy.

7 reasons why the All-in-One strategy is convincing

- Broad diversification

- Combination of several asset classes

- Experienced management

- Transparent structure

- Long-term orientation

- Adaptability to market phases

- Proven performance

Conclusion

wikifolio offers investors and traders an innovative platform to implement strategies transparently. The All-in-One strategy of Thomas Jochen Wagner, MBA shows how well thought-out diversification can lead to stable returns. Click here to go directly to the portfolio.

Disclaimer & risk warning

The contents of this wikifolio do not constitute investment advice or a recommendation to buy or sell financial instruments. Investments in securities and other financial products are associated with considerable risks, including the complete loss of the capital invested. Past performance is no guarantee of future results. Liability for loss or damage arising from the use of the information provided or the wikifolio is excluded.

Back to the home page: Crypto Recovery